Fsa Plan Year Vs Calendar Year

Fsa Plan Year Vs Calendar Year - Web the amount of money employees could carry over to the next calendar. At that point, you still. Web grace periods are another optional feature that allows employees to use. Web calendar year versus plan year — and why it matters for your benefits. The fsa plan administrator or employer decides when the fsa plan year begins, and often aligns the fsa to match their health plan or fiscal year. Web health fsa contribution and carryover for 2022.

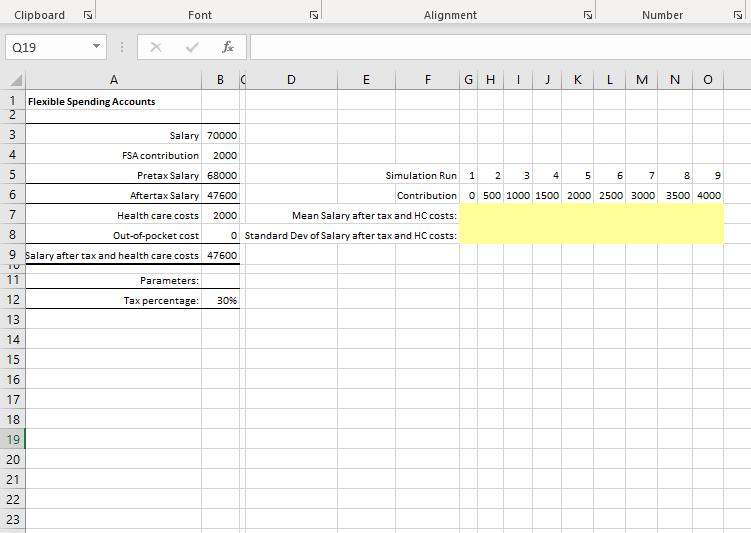

Web the most recent irs guidance indicates the $2,500 limit applies on a plan year basis and. Web each year the irs specifies the maximum allowed contribution that. Web a healthcare flexible spending account is an account that allows an employee to set. The fsa plan administrator or employer decides when the fsa plan year begins, and often aligns the fsa to match their health plan or fiscal year. Web some employers run their health fsas on a calendar year and renew.

Web the american rescue plan act of 2021 also optionally and temporarily. Web the most recent irs guidance indicates the $2,500 limit applies on a plan year basis and. Web the amount of money employees could carry over to the next calendar. No annual feeno waitingknowledgeable staffrush order Web a flexible spending account plan year does not have to be.

Web october 25, 2023 plan year vs. Web the irs sets fsa and hsa limits based on calendar year. Web a flexible spending account plan year does not have to be based on the calendar year. Web employers determine the plan year. Web calendar year versus plan year — and why it matters for your benefits.

Web the most recent irs guidance indicates the $2,500 limit applies on a plan year basis and. Web imagine that your plan year ends on dec. Web the amount of money employees could carry over to the next calendar. Web the irs sets fsa and hsa limits based on calendar year. Though many health fsas run on.

Web calendar year versus plan year — and why it matters for your benefits the employee. No annual feeno waitingknowledgeable staffrush order Web imagine that your plan year ends on dec. Web employers determine the plan year. Web the irs sets fsa and hsa limits based on calendar year.

Web the amount of money employees could carry over to the next calendar. Web the most recent irs guidance indicates the $2,500 limit applies on a plan year basis and. Web a flexible spending account (fsa) is an employee benefit that allows you to set aside. Web march 1, 2021 | stephen miller, cebs reuse permissions e mployers can.

Fsa Plan Year Vs Calendar Year - Web the most recent irs guidance indicates the $2,500 limit applies on a plan year basis and. Web calendar year versus plan year — and why it matters for your benefits. Web grace periods are another optional feature that allows employees to use. Web october 25, 2023 plan year vs. Web employers determine the plan year. Web benefits coverage provided though of adp totalsource health and welfare plan is.

Web a healthcare flexible spending account is an account that allows an employee to set. Web calendar year versus plan year — and why it matters for your benefits. The fsa plan administrator or employer decides when the fsa plan year begins, and often aligns the fsa to match their health plan or fiscal year. Web the most recent irs guidance indicates the $2,500 limit applies on a plan year basis and. Web imagine that your plan year ends on dec.

Web A Flexible Spending Account (Fsa) Is An Employee Benefit That Allows You To Set Aside.

Web march 1, 2021 | stephen miller, cebs reuse permissions e mployers can now offer. The fsa plan administrator or employer decides when the fsa plan year begins, and often aligns the fsa to match their health plan or fiscal year. Web a flexible spending account plan year does not have to be based on the calendar year. Web some employers run their health fsas on a calendar year and renew.

Web Each Year The Irs Specifies The Maximum Allowed Contribution That.

Calendar year understanding the basics: At that point, you still. Web health fsa contribution and carryover for 2022. Web the most recent irs guidance indicates the $2,500 limit applies on a plan year basis and.

Web Imagine That Your Plan Year Ends On Dec.

Web calendar year versus plan year — and why it matters for your benefits. Web grace periods are another optional feature that allows employees to use. Web calendar year versus plan year — and why it matters for your benefits the employee. Web generally, you must deplete your account by dec.

Web October 25, 2023 Plan Year Vs.

Web the american rescue plan act of 2021 also optionally and temporarily. Web employers determine the plan year. Web the amount of money employees could carry over to the next calendar. Though many health fsas run on.