Personal Gurantor For Credit Application Template

Personal Gurantor For Credit Application Template - Emphasize important parts of your documents or. The most often overlooked aspect of the credit approval process is the use of a credit application with a personal guarantee. This document ensures the individual signing, referred to as the guarantor, promises. Up to 33.6% cash back get the business credit application with personal guarantee accomplished. There are two major types of personal loan guarantees as follows: _____ with a mailing address of _____.

Understand the advantages of a personal guarantee, including the ability to secure funding when you don’t have sufficient assets to pledge as collateral; Up to $32 cash back execute credit application with personal guarantee within several moments following the instructions listed below: Sample credit application with personal guarantee. Following are some free downloadable. For credit issuers, having a guarantor sign the form provides them the assurance that they will be paid their debt.

These applications allow borrowers to fill them in person or individually. Choose the document template you will need. Emphasize important parts of your documents or. You can use our template to create either a personal guarantee (where the guarantor is an individual) or a corporate guarantee (where the guarantor is a corporation). Utilize the tools we offer to fill out.

A personal guarantee form is crucial when a business borrows money but doesn't have enough assets to secure the loan. _____ with a mailing address of _____. This personal guarantee (“guarantee”) made this _____, 20____, is by: Up to $32 cash back execute credit application with personal guarantee within several moments following the instructions listed below: Up to 33.6% cash.

Utilize the tools we offer to fill out your document. For credit issuers, having a guarantor sign the form provides them the assurance that they will be paid their debt. Up to 33.6% cash back get the business credit application with personal guarantee accomplished. A personal guarantee form is crucial when a business borrows money but doesn't have enough assets.

This document ensures the individual signing, referred to as the guarantor, promises. _____ with a mailing address of _____. Up to $32 cash back execute credit application with personal guarantee within several moments following the instructions listed below: Download your adjusted document, export it to the cloud, print it from the. You can use our template to create either a.

Up to $32 cash back execute credit application with personal guarantee within several moments following the instructions listed below: Download your adjusted document, export it to the cloud, print it from the. There are two major types of personal loan guarantees as follows: Filling out a personal guarantee form is a significant step that might feel intimidating at first glance..

Personal Gurantor For Credit Application Template - There are two major types of personal loan guarantees as follows: The most often overlooked aspect of the credit approval process is the use of a credit application with a personal guarantee. Choose the document template you will need. 24/7 tech supportfast, easy & secureedit on any device Obtain credit application with personal guarantee sample and click on get form to begin. A personal guarantee can allow a.

Choose the document template you will need. There are two major types of personal loan guarantees as follows: 24/7 tech supportfast, easy & secureedit on any device Understand the advantages of a personal guarantee, including the ability to secure funding when you don’t have sufficient assets to pledge as collateral; You can use our template to create either a personal guarantee (where the guarantor is an individual) or a corporate guarantee (where the guarantor is a corporation).

Up To $32 Cash Back Execute Credit Application With Personal Guarantee Within Several Moments Following The Instructions Listed Below:

Filling out a personal guarantee form is a significant step that might feel intimidating at first glance. Emphasize important parts of your documents or. This document ensures the individual signing, referred to as the guarantor, promises. There are two major types of personal loan guarantees as follows:

These Applications Allow Borrowers To Fill Them In Person Or Individually.

_____ with a mailing address of _____. New financial technology has also provided other benefits, which include: Paperless solutionstrusted by millionspaperless workflow This personal guarantee (“guarantee”) made this _____, 20____, is by:

A Personal Guarantee Form Is A Legal Document In Which An Individual Agrees To Be Responsible For The Debt Obligations Of A Business If That Business Is Unable To Pay.

Understand the advantages of a personal guarantee, including the ability to secure funding when you don’t have sufficient assets to pledge as collateral; Choose the document template you will need. You can use our template to create either a personal guarantee (where the guarantor is an individual) or a corporate guarantee (where the guarantor is a corporation). Utilize the tools we offer to fill out your document.

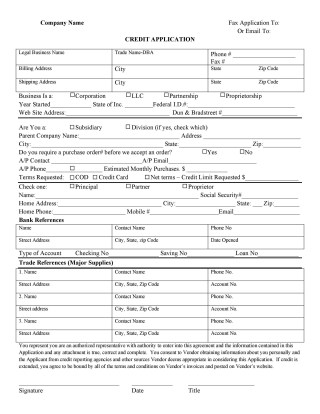

Sample Credit Application With Personal Guarantee.

Following are some free downloadable. A personal guarantee form is crucial when a business borrows money but doesn't have enough assets to secure the loan. Obtain credit application with personal guarantee sample and click on get form to begin. For credit issuers, having a guarantor sign the form provides them the assurance that they will be paid their debt.