1096 Fillable Form

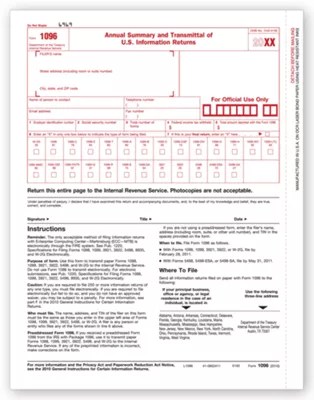

1096 Fillable Form - Web what is irs form 1096? Form 1096, or the annual summary and transmittal of u.s. If you’re a small business, odds are you’ll mainly be using it to submit form 1099. Attention filers of form 1096: Enter the filer’s name, address. Explaining the basics of form 1096.

Enter the filer’s name, address. Why do you need it? Web show sources > about the corporate income tax. Click on employer and information returns,. Web what is irs form 1096?

Information returns online and print it. Attention filers of form 1096: Web information about form 1096, annual summary and transmittal of u.s. The irs and most states require corporations to file an income tax return, with the exact filing requirements depending on. It appears in red, similar to the official irs form.

The purpose of form 1096 is to provide a concise summary of the 1099 forms that are. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Web information about form 1096, annual summary and transmittal of u.s. Enter the filer’s name, address. Explaining the basics of form 1096.

Enter the filer’s name, address. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are. Web what is irs form 1096? Attention filers of form 1096: Form 1096, or the annual summary and transmittal of u.s.

This form is provided for informational purposes only. 4.5/5 (117k reviews) Information returns online and print it. Web show sources > about the corporate income tax. Any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs.

Fill out the annual summary and transmittal of u.s. Form 1096 is a key transmittal form summarizing information reported to the irs on forms such as 1099,. 4.5/5 (117k reviews) Click on employer and information returns,. Attention filers of form 1096:

1096 Fillable Form - Web show sources > about the corporate income tax. 4.5/5 (117k reviews) Explaining the basics of form 1096. It appears in red, similar to the official irs form. Web what is irs form 1096? What is form 1096, and when is it required to be filed?

4.5/5 (117k reviews) If you’re a small business, odds are you’ll mainly be using it to submit form 1099. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are. Any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs. Explaining the basics of form 1096.

It Appears In Red, Similar To The Official Irs Form.

It appears in red, similar to the official irs form. Enter the filer’s name, address. What is form 1096, and when is it required to be filed? This form is provided for informational purposes only.

Web Show Sources > About The Corporate Income Tax.

Web information about form 1096, annual summary and transmittal of u.s. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Attention filers of form 1096: The irs and most states require corporations to file an income tax return, with the exact filing requirements depending on.

Form 1096 Is A Key Transmittal Form Summarizing Information Reported To The Irs On Forms Such As 1099,.

Web what is irs form 1096? Why do you need it? Explaining the basics of form 1096. Information returns online and print it.

The Purpose Of Form 1096 Is To Provide A Concise Summary Of The 1099 Forms That Are.

Form 1096, or the annual summary and transmittal of u.s. Information returns, including recent updates, related forms and instructions on how to file. This form is provided for informational purposes only. If you’re a small business, odds are you’ll mainly be using it to submit form 1099.