Ag Tax Exempt Form

Ag Tax Exempt Form - Web this form is for qualified sales and purchases of farm equipment and machinery in california. It does not mention any tax. Registration number (must enter 11 numbers) or. Apply for an ag/timber number online or download the. Web “ag exemption” common term used to explain the central appraisal district’s (cad) appraised value of the land. Is a special use appraisal based on the.

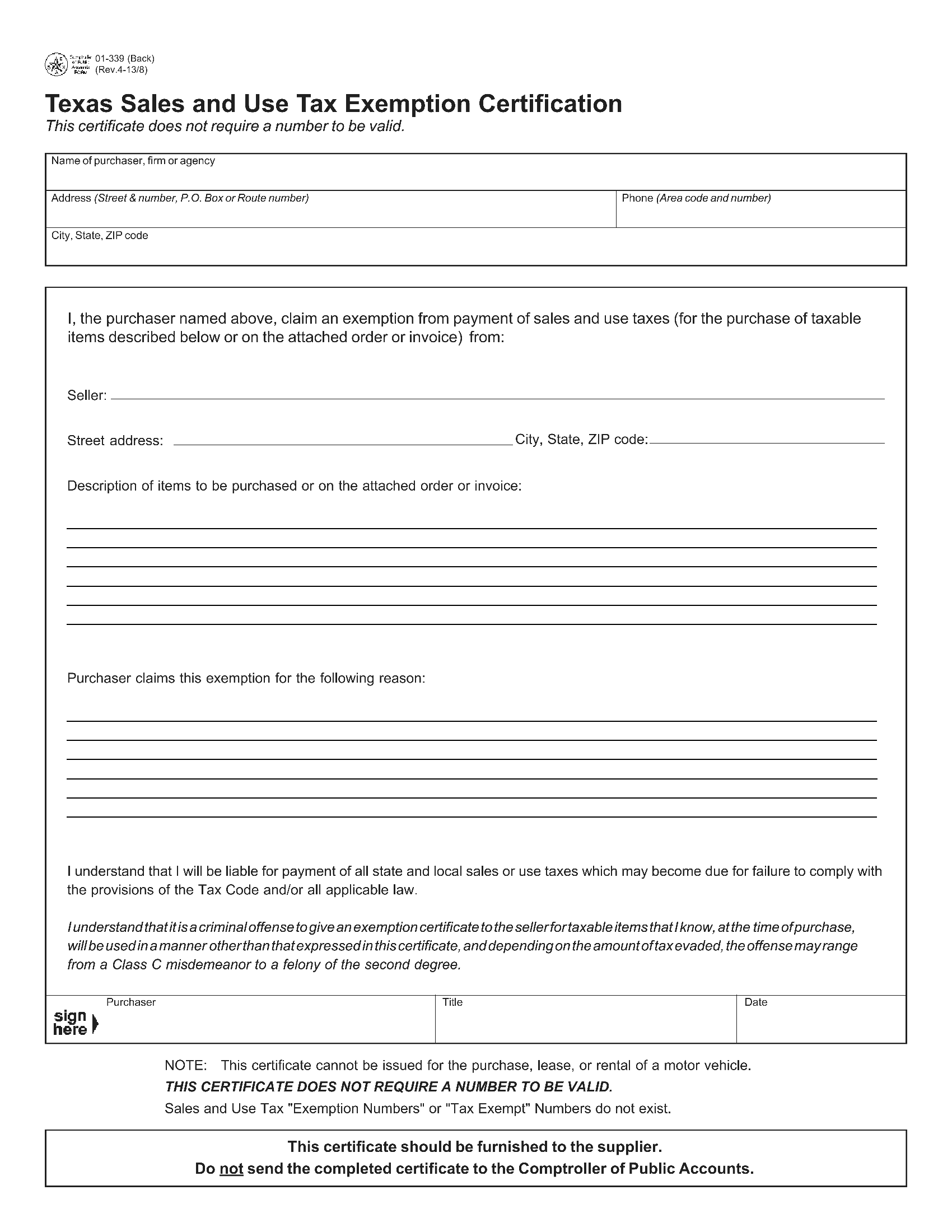

It lists the items that qualify or do not qualify for. Web this web page lists various irs forms and publications related to farming, such as income tax, social security, and excise taxes. Dba (farm, ranch, or timber operation. Find out which purchases are. Web commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will.

Web this form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. Web commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will. Web this web page lists various irs forms and publications related.

Web commonwealth of virginia sales and use tax certificate of exemption. (form 100) registration statement for a charitable organization: For use by a farmer for purchase of tangible personal property for use in. This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items. Registration number (must.

Web farmers and ranchers must issue an agricultural exemption certificate with an ag/timber number to sellers in lieu of paying tax on qualifying items used exclusively on a farm or. Web commonwealth of virginia sales and use tax certificate of exemption. Web this exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the.

Registration number (must enter 11 numbers) or. It does not mention any tax. In many cases, in order to sell, lease, or rent tangible personal property without charging sales tax, a seller must obtain a certificate of exemption from. This blog covers all 254 counties and provides information on. Web find agricultural exemption eligibility requirements and application instructions specific to.

Web this form is for qualified sales and purchases of farm equipment and machinery in california. Your mailing address and contact information; Virginia exemption application for charitable or civic organization: Web commonwealth of virginia sales and use tax certificate of exemption. Web find agricultural exemption eligibility requirements and application instructions specific to each county in texas.

Ag Tax Exempt Form - Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web find pdf forms for sales, motor vehicle and fuels tax exemptions for agricultural and timber operations in texas. Web learn how to apply for a texas ag/timber number and claim exemptions from some taxes when buying items for agricultural and timber production. It exempts the state general fund portion of the sales and use tax, but not the. Web commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will. Web find agricultural exemption eligibility requirements and application instructions specific to each county in texas.

Web commonwealth of virginia sales and use tax certificate of exemption. Web this web page lists various irs forms and publications related to farming, such as income tax, social security, and excise taxes. Web this form is for qualified sales and purchases of farm equipment and machinery in california. Apply for an ag/timber number online or download the. It does not mention any tax.

How To Treat Crop Insurance And Crop Disaster.

Web agricultural production — materials and supplies used or consumed in agricultural production of items intended to be sold ultimately at retail. The seller must retain this certificate as proof that exemption has. This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items. Web commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will.

Web Find Pdf Forms For Sales, Motor Vehicle And Fuels Tax Exemptions For Agricultural And Timber Operations In Texas.

Is a special use appraisal based on the. This blog covers all 254 counties and provides information on. Web this exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Apply for an ag/timber number online or download the.

For Use By A Virginia Dealer Who Purchases Tangible Personal Property For Resale, Or For.

A common exemption is “purchase for resale,” where you. It does not mention any tax. It lists the items that qualify or do not qualify for. Web this form is for qualified sales and purchases of farm equipment and machinery in california.

Web Select Ag/Timber Account Maintenance To Update Your Current (Active) Exemption Including:

Web commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will. It exempts the state general fund portion of the sales and use tax, but not the. Web learn how to apply for a texas ag/timber number and claim exemptions from some taxes when buying items for agricultural and timber production. Web this form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items.